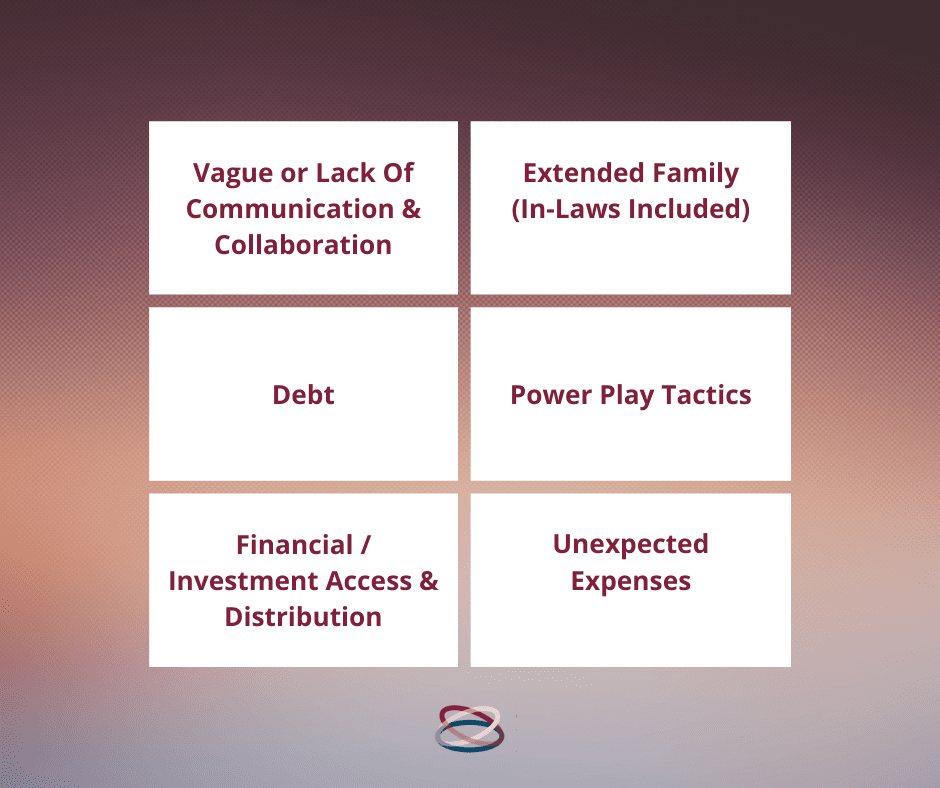

6 Money Issues that can kill your marriage

Money is one of the leading causes of divorce. Couples who have money issues are more likely to get divorced than those who don’t have money issues. These 6 money issues that can kill your marriage are listed below.

Here are the top 6 issues that can kill your marriage:

Arguing about money

Arguments about money can cause a rift in an otherwise solid relationship. Often, it is because of a fundamental difference in philosophy about money management. Having different ideas on how to save, spend and manage money can be difficult if the partners are not on a level playing field i.e., one has a more significant salary or one had more assets prior to entering the relationship.

Spending money irresponsibly

We all have impulsive tendencies that may involve irresponsible behaviour when it comes to money management. “I work for it so I can spend how I see fit” is a recipe for resentment and confrontation. In this situation the damage is twofold, goals go unfulfilled, and distrust begins to form in the relationship. Purchases, especially major ones should be discussed.

Not being able to agree on financial goals

Couples who do not have similar goals run the risk of torpedoing each others’ efforts in attaining those goals. If for example, one is saving for a home and the other for that fancy vehicle, as stated above the damage is done on multiple levels. The relationship suffers and the goals are not achieved. This can lead to the dissolving of the marriage in search of better financial footing.

Having different attitudes towards money

Even if the thought of saving has entered the conversation, how to save can cause stress in a relationship. There are many different vehicles for saving and building liquidity and all come with a certain level of risk and reward. If one partner is conservative and the other willing to accept a higher level of risk, then often the strategy does not line up. This can cause issues in the marriage when losses are experienced.

Not being able to agree on how to spend money

Major purchases will happen in any relationship. Any major purchase should be discussed and agreed upon. It is important to remember that you cannot always get have it your way. Pick and choose your battles carefully. Compromise is not the same as giving in. You may have to ease up on an argument today, to win one tomorrow.

Concealing financial information from your spouse

Even with the best of intentions hiding financial information, hidden money reserves, bank accounts, stocks and bonds from family members can be seen as deceitful and may lead to a breakdown in the trust of the relationship. Put all your cards on the table and then decide the best way to manage “the pot”.

Money is such a contentious because people often have different attitudes and beliefs about it. For some, money is seen as a tool to achieve their goals, while others use it to provide for family. Some are spenders and others are savers, this difference in philosophy can lead to disagreements and conflict.

When money is a source of conflict in a relationship, it can often lead to a breakup. In a separation, it can also lead to a division of assets. To avoid these problems, it is important for couples to discuss their views on money and to come to an agreement about how they will handle their finances.

6 Tips to avoid money becoming an issue in your marriage

Get on the same page.

Try to understand each others’ goals and how they wish to achieve them. There may be some give and take but when the financial plan is agreed on both parties it has a better chance to succeed.

Manage your debt.

Make sure major purchases are agreed upon. Nobody likes a surprise call from a creditor or a declined transaction at the counter.

Remember unexpected things happen.

Playing the blame game does not help the situation. Instead try and learn from the experience so you are better prepared next time. If your partner caused the issue, help them understand what happened and how to prevent it from happening again.

Discuss financial matters with an expert.

Preferably someone who is unrelated. Family members may mean well but can inadvertently cause tensions in relationships with bad advice. If your family member is an expert than talk to him/her together. Show a unified front.

Share the responsibilities.

Regardless of who makes more money share the responsibilities equally. There are other ways to contribute other than financially, but they are just as important. No power plays or income flexing, you are in this together.

Know each others financial standing.

Be sure to understand where each person is in their financial journey before you enter a relationship. If one has greater debt than the other, then discuss how this can impact the relationship and what is or can be done to minimize the stress of both parties carrying this debt.

Money and division of assets is often a source of conflict in a separation.

Money is often a source of conflict in mediation when dealing with the division of assets. Many studies have shown that money was cited as the number one issue in divorces.

Who decides how to divide our assets?

There are many people who can decide how to divide your property and/or assets. You and your spouse may decide how to divide your property and then incorporate it into an agreement. Your agreements may arrive either independently, or with the help of a divorce mediator or lawyer.

If you are unable to reach a decision on your own, an arbitrator may decide how to divide your property based on either your and your spouse’s wishes or based on the provisions found in the Family Law Act.

Finally, the court may decide how to divide your property if you and your spouse cannot reach an agreement through mediation or arbitration. The courts will defer to an agreement between the both of you.

There is no obligation for court

There is no obligation for you and your spouse to go to court, or to divide your net family property as it would be divided under the Family Law Act. You are free to decide on the division of your property as you choose, and then incorporate your decisions into a separation agreement formalizing your arrangement. One of the best ways to stay in control of how your assets and money are divided after separation is to create your own separation agreement through the help of a divorce mediator. It is advisable that you get legal advice before finalizing any property sharing agreement, particularly if the marriage has been a lengthy one and you have built up considerable assets during that time.

Conclusion

Money is one of the leading causes of divorce, and it’s important to address any money issues before you get married. Honesty is and has always been the best policy. It’s not always easy but the conversation should always be clear, intentional, and specific in stating your desired outcomes. Remember that you must give ground to gain ground, and compromise for the good of your goals and the health of your relationship.

When it’s time to go your separate ways, we can help you move forward peacefully.

South Simcoe Family Mediation Services guides you through separation and divorce in Ontario towards the best possible outcome for everyone.

Phone

(705) 986-1870 - (249) 888-9122

Toll Free: 1-855-405-8891

Hours

Flexible hours including evening and weekend appointments.

Jennifer Curry - AccFM

Family Mediator at South Simcoe Family Mediation